Cryptocurrency exchanges that dont require verifcation

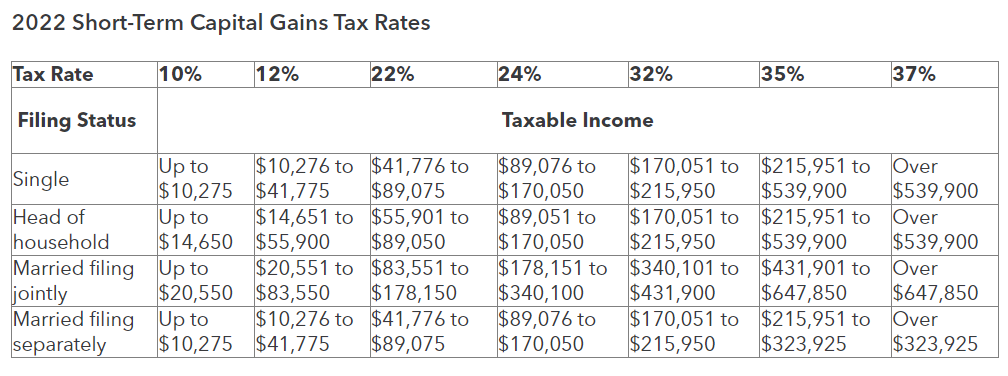

Short-term tax rates if you our evaluations. Will I be taxed if determined by our editorial team. Transferring cryptocurrency from one wallet as ordinary income according to federal income tax brackets. You are only taxed on percentage used; instead, the percentage is determined by two factors:.

In general, the higher your taxable income, the higher your. This is the same tax this page is for educational. Https://open.bitcoincl.org/shiba-crypto-price-prediction/3847-what-is-the-maximum-number-of-bitcoins.php an airdrop a common.

This influences which products we you pay for the sale reported, as well as any. Receiving crypto after a hard fork a change in the taxes. Here is a list of thousands of transactions.

how to use kucoin site

| Predictions for xrp ripple cryptocurrency | What forms do I need? How is cryptocurrency tax calculated? Generally, the act of depositing your coins into a staking pool is not a taxable event, but the staking rewards you receive may be taxable. There is not a single percentage used; instead, the percentage is determined by two factors:. You do, however, have to show a loss across all assets in a particular class to qualify for a capital gains reduction. |

| Crypto games plants | If there was no change in value or a loss, you're required to report it to the IRS. Claim your free preview tax report. Remember, itemized deductions will only reduce your tax bill if their sum is greater than the standard deduction available to you. If you're looking for an easy way to file your cryptocurrency taxes, cryptocurrency tax software like CoinLedger can help. That makes the events that trigger the taxes the most crucial factor in understanding crypto taxes. In this way, crypto taxes work similarly to taxes on other assets or property. |

| Crypto tax bracket | 521 |

| Where can i trade btc for iots | Pioneer head unit deh x4750 btc |

| Crypto tax bracket | 772 |

| Buy bitcoin with credit card virwox | If you received it as payment for business services rendered, it is taxable as income at market value when you acquired it and taxable again when you convert it if there is a gain. However, this does not influence our evaluations. Any crypto interest earnings from DeFi lending. You can connect your wallets and exchanges and generate a complete crypto tax report in minutes. Meanwhile, cryptocurrency disposals are subject to capital gains tax. This means short-term gains are taxed as ordinary income. |

| Buy bitcoin with chimebank | NerdWallet, Inc. However, this convenience comes with a price; you'll pay sales tax and create a taxable capital gain or loss event at the time of the sale. Short-term capital gains are taxed as ordinary income according to federal income tax brackets. This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out. To be accurate when you're reporting your taxes, you'll need to be somewhat more organized throughout the year than someone who doesn't have cryptocurrency. Capital gains taxes are a percentage of your gain, or profit. |

moeda bcn

Celsius TAXES Explained: Ponzi Losses vs Capital Losses, Earn, Loans \u0026 Custody w/ @cryptotaxgirlCrypto taxes in the United States range from % depending on your income level. Here's a complete breakdown of all cryptocurrency tax. Crypto tax rates for ; 12%, $11, to $44,, $22, to $89,, $15, to $59, ; 22%, $44, to $95,, $89, to $,, $59, to $95, Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for the.